Toronto Maple Leafs Captain Engages in Controversial Tax Battle with Canadian Agency

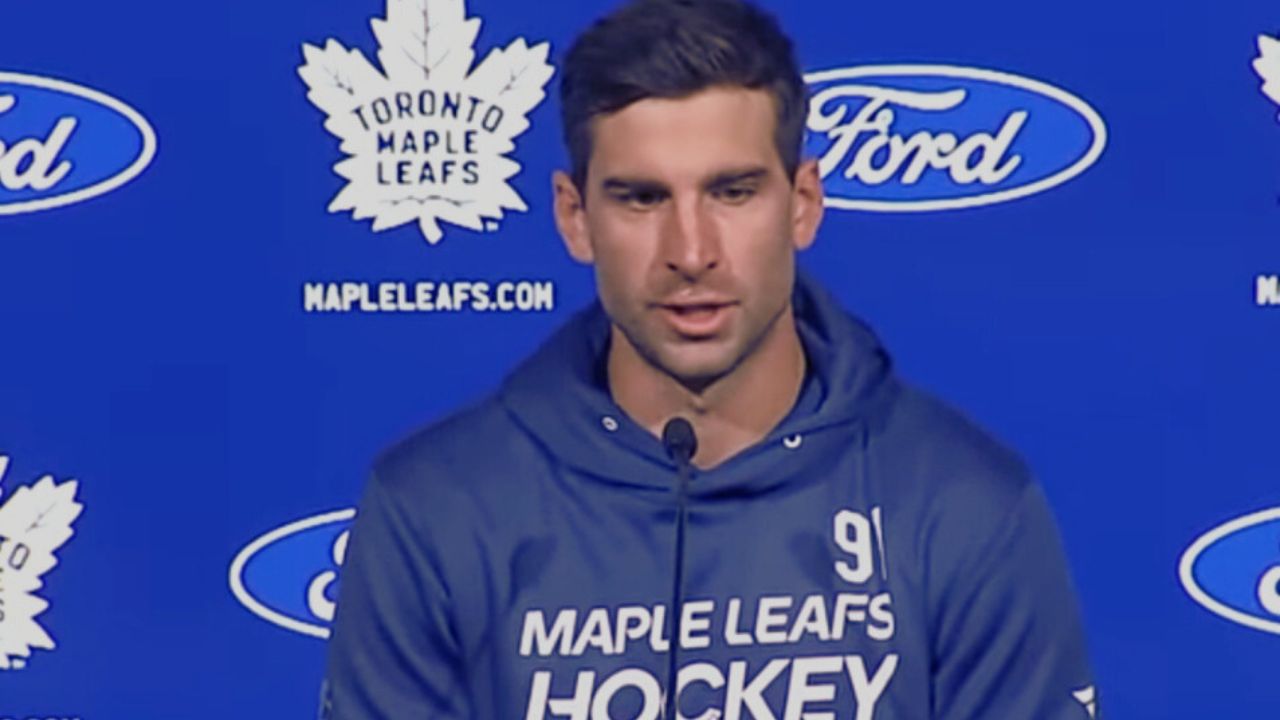

Toronto Maple Leafs captain John Tavares finds himself in a legal tussle with the Canada Revenue Agency (CRA) over an astounding $8 million tax bill. The controversy revolves around a jaw-dropping $15.3 million signing bonus that Tavares received upon joining the Maple Leafs in 2018. The star player contests the CRA’s claim that the bonus should be taxed at a whopping 38%, arguing for a much lower rate of 15%, as per the Canada-U.S. taxation treaty.

Maple Leafs captain John Tavares is fighting the Canada Revenue Agency over an $8M tax bill.

Tavares says he should owe 15% on a US$15.3M signing bonus he received when he signed with Toronto in 2018. The CRA says the bonus should be taxed at 38%.

via @glen_mcgregor…

— Rick Westhead (@rwesthead) February 7, 2024

Social Media Erupts as Fans Express Outrage over Tax Discrepancy

As the news of the tax dispute spreads like wildfire across social media, fans are left stunned by the glaring discrepancy in tax rates. One bewildered fan exclaims,

“15%? While I get taxed like 40%?”

15%???? While I get taxed like 40%?????

— Val ❤️🔥 (@sassyvbalotelli) February 7, 2024

Another fan highlights the broader implications, stating,

“And they wonder why players sign in Florida and Texas. There needs to be tax parity for an equal playing field.”

And they wonder why players sign in Florida and Texas. I have no problem with a tax but there needs to be tax parity to have an equal playing field for every team. Hopefully the next CBA addresses this.

— Sean 🇨🇦 (@Sean211277) February 7, 2024

Expressing the frustration of everyday individuals, a regular fan questions,

“I’m just a regular dude, and each additional dollar I earn gets taxed at 53%. How does he get away with only paying 38%?”

I’m just a regular dude and each additional dollar I earn gets taxed at 53%. I’m not even totally sure how he would get away with only paying 38%.

— FlashDavin (@FlashDavinYT) February 7, 2024

I feel his pain, my cell bill just went up 4 bucks a month.

— Dave Carson (@CarsonRagnar) February 7, 2024

Isn’t 15% like the lowest tax bracket?

— DK (@dsky28) February 7, 2024

Not sure who does maths on both sides but 38% of 15.3 millions does not equal 8 million

— Yves Savignac (@Ysavignac27) February 7, 2024

Now he for sure won’t be signing for a hometown discount next contract.

— mmarkwell (@mmarkwell) February 7, 2024

Tavares Challenges Canada Revenue Agency on $8M Tax Bill for Signing Bonus

Delving into the details of John Tavares’s tax predicament, the Toronto Maple Leafs captain now finds himself embroiled in a legal battle with the Canada Revenue Agency. The $8 million tax bill stems from the signing bonus he received in 2018. Tavares firmly contests the CRA’s assessment, asserting that the bonus should be subject to a 15% tax rate, in accordance with the Canada-U.S. taxation treaty.

Implications for Tax Parity in Professional Sports as Tavares Appeals to Tax Court

The outcome of this dispute holds significant implications, not just for Tavares but for Canadian professional sports teams as a whole. The ability to sign top players may be affected, potentially disrupting tax parity across the league. Tavares’s appeal to the Tax Court of Canada hinges on the argument that the bonus should be classified as an inducement rather than employment income, thus warranting the lower tax rate.

High-Stakes Legal Battle: Tavares Argues for 15% Tax Rate on $15.3M Signing Bonus

Tavares’s decision to join the Toronto Maple Leafs, despite the higher tax rates in Canada, was heavily influenced by the signing bonus. However, the CRA’s reassessment claims that Tavares owes an additional $6.8 million in taxes and $1.2 million in interest, based on unreported income.

The crux of Tavares’s argument lies in the taxation of the bonus. He believes that since the bonus was deposited into his U.S. bank account, it should be taxed at the U.S. rate. The outcome of this case holds significant implications for future contracts and tax considerations for professional athletes playing in Canada.

As the legal battle intensifies, all eyes are on John Tavares and the Tax Court of Canada, with the potential to reshape tax policies and regulations in professional sports. The outcome will undoubtedly have a lasting impact on the financial landscape of the league and the livelihoods of its star players.

Editor’s Note:

The tax dispute involving John Tavares and the Canada Revenue Agency has ignited a spirited debate among fans and taxpayers alike. The stark contrast in tax rates between Tavares and ordinary individuals has raised questions about fairness and tax parity within the sports industry. This contentious issue highlights the complexities of taxation in professional sports and underscores the need for a comprehensive examination of the current system. As the legal proceedings unfold, we will continue to follow the developments closely and provide updates on this high-profile case.